There is a little-known way of living in the UK without paying tax: the non-domiciled or non-dom regime.

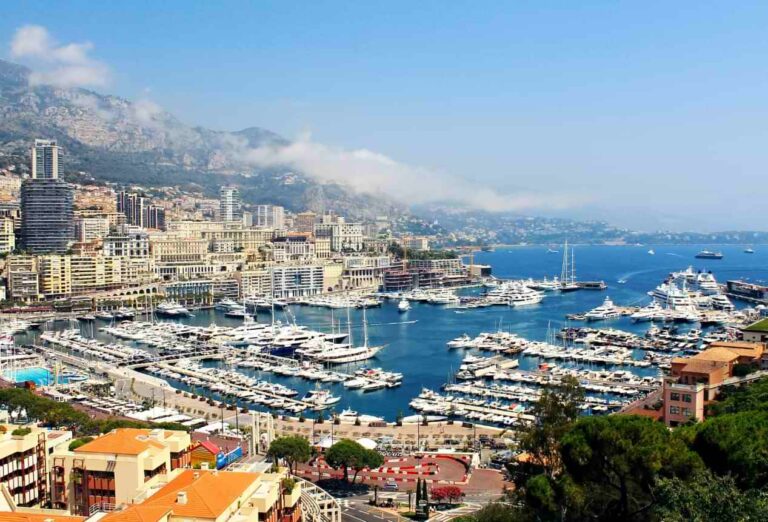

For decades, executives, wealthy families, oligarchs, sheikhs and businessmen have chosen London not only because it is a cosmopolitan city, but also because of its beneficial non-dom tax status.

Illustrious figures such as Lakshmi Mittal, Bernie Ecclestone, Roman Abramovich and Alisher Usmanov chose London and non-domiciled status to establish their business empires.

What are the requirements for the non-domiciled regime?

The non-dom regime is available to any non-UK national who wishes to settle in the UK without the intention of remaining in the UK forever.

As of today, since 2017, the definition of “intent to remain” states that those who have been resident in the UK for 15 out of the previous 20 years are considered to be domiciled in the UK.

Therefore, the non-dom regime can only be enjoyed for a maximum of 15 years.

How to acquire this regime?

In order for a person to qualify for the non-dom regime it is necessary for them to obtain both tax residence and a residence permit in the UK.

Thus, to acquire tax residence, in general, it is necessary to prove that you have spent more than 183 days of the year in the UK, or at least more days in the UK than in any other country.

How does it work?

This regime is characterised by the following:

- No taxation of income received from abroad, except if it is remitted to the UK, known as the “remittance basis” (see next section).

- Exclusive taxation only on income and capital gains arising in the UK.

- Free of charge for the first seven years.

- After seven years, the non-domiciled resident regime involves paying £30,000 per year.

- From the twelfth year onwards, the cost of applying non-dom will be £70,000 per year.

What does it mean remitted income?

Income received from abroad will only be taxed if it is remitted to the UK.

In this regard, remittance means moving money to the UK in some way – from making a bank transfer to a UK account to withdrawing money from a cash machine.

A person relying on the non-dom regime must be able to demonstrate that they have sufficient means to live in the UK and that they are remitting sufficient capital to the UK to do so.

Although it has not been determined how much has to be remitted each year by HMRC, the remittance basis rule implies that it should be a minimum to live comfortably.

Consequently, tax planning is necessary to ensure that the relocation of residence is beneficial, and it is preferable that this planning is carried out prior to the change of residence.

How is remitted income taxed?

Remitted income is taxed at the standard UK rate: tax rates are approximately 20% for income up to £37,700 and 45% for income over £150,000.

The HRMC website has a tax calculator which will help you estimate how much tax you will pay.

Will non-doms pay wealth, inheritance or gift tax?

Non-doms will not pay wealth tax in the UK. However, there is a fairly heavy inheritance and gift tax of up to 40%.

In this regard, this tax would only be payable if the donor dies within 7 years of the gift, otherwise the gift is exempt.

How to take the first step?

Over the last few years, Relocate&Save has helped large estates and crypto-investors to transfer their tax residence to the UK through the non dom regime.

Our presence and contacts in the UK make us an ideal partner for this arduous task, so if you would like us to help you with the process, please write to us at [email protected] or via the contact form.

You can also download our “The top three tax destinations right now” report, available for free below.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.