Update

The Portuguese NHR scheme mentioned in this article has been discontinued, we are currently waiting for the new Portuguese government to implement an alternative solution.

Contact us via the form or write to us at [email protected] explaining your situation, and we will keep you informed of developments and let you know about alternative tax destinations.

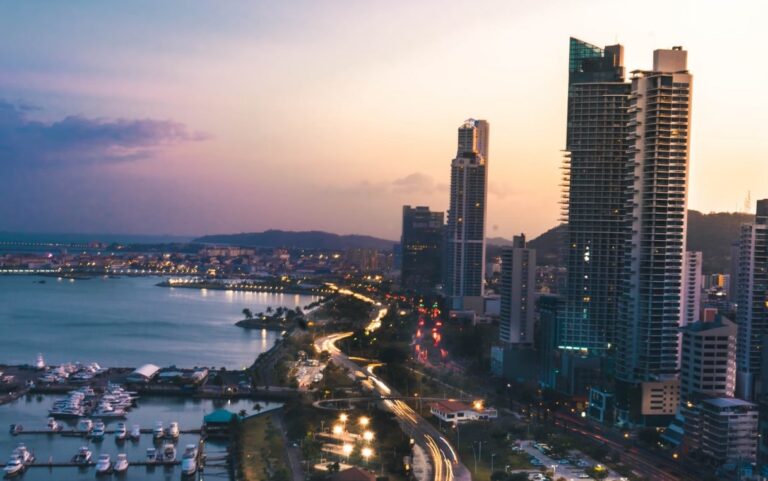

Although Panama, Delaware and Switzerland are options that clients often put on the table, these are jurisdictions that attract the attention of tax administrations and may involve tax inspectors reviewing your departure.

Portugal, on the other hand, is a full-fledged European Union country, with a jurisdiction that is widely accepted internationally and is not included in any list of tax havens.

The exit to Portugal is safe since, a priori, it does not attract attention as a destination for tax evasion. That is why we are helping more and more clients from Spain, Latin America and the world to move their tax residence to Portugal, where they end up enjoying very significant tax savings.

In fact, famous and rich people such as Madonna, the actor John Malkovich or Marcos de Quinto (former vice-president of The Coca Cola Company) have already opted to move to Portugal some time ago.

And why Portugal? Will I really pay less tax?

Generally speaking, for tax residents in Portugal the Income Tax is very high and unattractive, but the Portuguese government years ago implemented the so-called Non-habitual residential regime (NHR) or Individual Income Tax (IRS), which exempts foreigners from paying on income coming from outside Portugal.

And why don’t all Portuguese people pay tax under this regime?

This regime is reserved for “singular”, “special” persons, i.e., high net worth individuals, High-net-worth individuals (HNWI), internet entrepreneurs, technical specialists, professionals of repute (lawyers, doctors, architects), artists, models, etc.

Therefore, in order to be NHR, i.e. “special”, the following is necessary:

-

- That the interested party has not been taxed as a tax resident in Portugal in any of the five years prior to the year in which this condition is requested.

- That the interested party meets the necessary conditions to be considered a tax resident in Portugal. Residence in Portuguese territory for tax purposes may be acquired, any year, among other situations, when the taxable person:

- Has stayed in Portuguese territory for more than 183 days, consecutive or alternate

- In case of having stayed less time, he has in Portuguese territory, on 31 December of that year, a dwelling in conditions that allow to suppose his intention to keep it and occupy it as a habitual residence

- Apply to the Portuguese tax authorities for the status of non-habitual tax resident until 31 March of the year following the year in which the attribution of this status is to take effect. In this regard, it is worth mentioning that obtaining this status is not automatic, but depends on prior assessment and approval by the tax authorities. The process of appreciation of each application and its subsequent granting, has an average duration of six months.

If I get NHR status, what advantages will I have?

If you get NHR status, you will be able to be taxed as an NHR for 10 years. That implies that for ten years:

- You will not pay tax on passive income from abroad, such as interest, dividends, capital gains, pension plans, pensions etc (with limitations on pensions from 2020).

- You will enjoy a special reduced tax rate of 15% for high value-added activities carried out from Portugal.

However, with respect to income originating in Portugal, this condition will allow the holder of income from employment and/or self-employment to benefit from the application of a reduced personal income tax rate of 20%, provided that such income results from the exercise of high value-added activities in accordance with the legally established definition. It should be noted that, in addition to the aforementioned special rate of 20%, an extraordinary personal income tax surcharge of 3.5% could also be applied to the income obtained.

And for whom would this regime be ideal?

This is an ideal tax regime for those pensioners or retirees with high purchasing power who want to reduce their tax burden and for highly qualified individuals such as artists, doctors, dentists, engineers, computer specialists, investors, administrators, managers, musicians, actors, etc.

Therefore, these individuals do not have to go to a remote island to pay less tax, they will be able to live in cosmopolitan places such as Lisbon, Porto or the Algarve and be taxed practically as if they were in a tax haven.

And if I am from Latin America can I apply to the NHR?

Because you are not in the European Union you will not have so easy, however, if you are a great wealth, thanks to the Golden Visa of Portugal or the residence by investment you can get to enter and travel around the European Union and also do it without paying taxes.

This visa can be obtained through an investment in real estate of 500.000 € or through other ways.

Are there better tax destinations than Portuguese?

If you are seriously interested in changing your tax residence, we recommend you to download for free and read our updated report “The top three tax destinations right now”, available below.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.