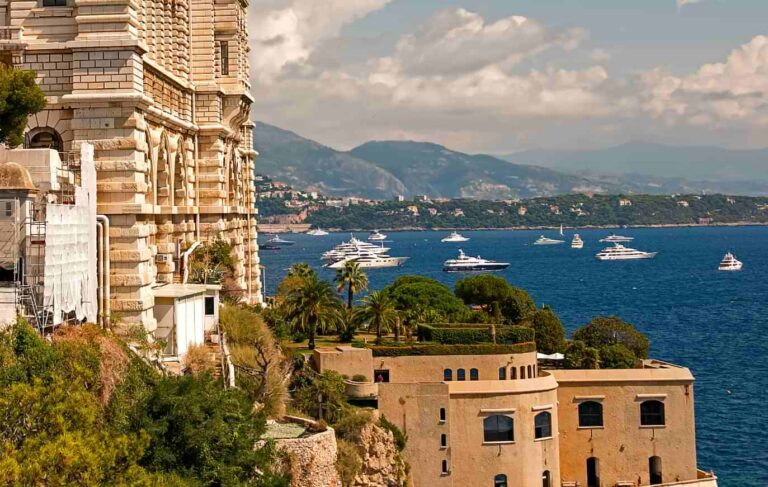

The Principality of Monaco is known among tourists for its luxury, casinos, Formula 1 Grand Prix, and beautiful locations.

But this small country of just 30,000 inhabitants is also very attractive as a permanent residence, offering security, social and economic stability, quality education and health systems, and, above all, no or low taxes.

It is no coincidence that the likes of Bono, Boris Becker, Lewis Hamilton, and Nico Rosberg among others have chosen this paradise as a place to live in. In fact, it’s said that one in three Monaco residents is a millionaire.

And, despite what many believe, Monaco is no longer a tax haven: it does have very low taxes, but both the European Union and the OECD have removed it from the list of non-cooperative jurisdictions or tax havens.

But, can you become a resident in Monaco through investment?

Golden Visa in Monaco

Unlike in other EU countries (e.g. Spain), Monaco does not have a Golden Visa or residence by investment as such.

However, foreigners who wish to obtain a residence permit in Monaco shall comply, among others, with certain financial requirements in order to prove before the Monegasque Authorities that they have sufficient financial resources.

This implies that, if you have sufficient financial solvency, you will be able to obtain Monegasque citizenship without any problem, even more easily than in other countries where there are Golden Visa programs.

Who can apply for a Monaco residence permit?

If you want to obtain residence in Monaco, all you have to do is apply to the Monegasque authorities for a residence permit.

Nationals of the EU and the European Economic Area (EEA) only need to have a valid identity card or passport before starting any procedure and fill in the forms of the Monegasque government, as long as a series of requirements are met.

If you are a non-EEA citizen, you can also apply for the residence permit provided that comply with several requirements. However, the process is longer than the one established for EEA citizens.

Requirements to obtain a residence permit in Monaco

Anyone who is at least 16 years old and wishes to reside in Monaco for more than 3 months in a year or, set up in the Principality, shall apply for a residence permit from the Monegasque authorities.

If you wish to stay in Monaco for a period that doesn’t exceed 3 months, the document required at entry into the French territory (passport, travel, or identity document) would be sufficient to stay in Monaco during the said period.

However, if you want to reside in Monaco for more than 3 months, as a foreigner, you shall comply with the following requirements:

Accommodation in Monaco

Foreigners shall be able to prove one of the following:

- They are the owner of a house or an apartment located in Monaco;

- They are the director of a company that owns properties in Monaco;

- They rent a house or an apartment in Monaco (at least for a minimum of 12 months);

- They are staying with a close relative, spouse, or partner.

In this sense, foreigners shall provide the Monegasque Authorities with:

- If you’re an owner, the property deed;

- If you’re the director of a company, the proof of share held in the company which owns properties in Monaco;

- If you’re renting, the tenancy agreement registered with the Department of Tax Services;

- If you’re staying with someone, a certificate of free accommodation that’s signed by the person you’re staying with.

Note that Monaco is one of the most expensive countries in Europe, so it’s important to consider that property prices and rentals are higher in comparison to other countries.

Generally, property prices in Monaco usually start from €1,000,000 with no upper limit, while flat rents can range from €4,000 to €40,000 (depending on the number of rooms).

Sufficient financial resources

It implies that the foreigner shall get a great salary (regardless of whether they’re an employee or a professional); sufficient savings (this is judged by the bank entity located in Monaco providing the reference); or be supported by a relative, spouse or partner with whom the foreigner is living as a couple.

Note that documents proving sufficient funds shall be translated into the French language.

In this sense, if the foreigner is:

- Self-employed, or the manager or director of a company in Monaco: a copy of the relevant Trade and Industry Register shall be supplied.

- A person who is setting up a business in Monaco: a receipt from the Business Development Agency confirming the admissibility of the application to start a business shall be supplied.

- An employee in Monaco: a certificate from the Employment Office authorizing employment in Monaco shall be supplied

- A person who is retired: proof of pension shall be supplied.

Also, a bank reference from a Monaco bank confirming that the foreigner has sufficient funds to live in Monaco may be supplied.

Note that the bank entity is responsible for determining whether the foreigner has sufficient funds. Normally, the foreigner should have savings of around €500,000.

Therefore, if you’re a foreigner and you wish to obtain a residence permit in Monaco, you have to be able to justify that you have savings of at least €500,000. If not, your application for the residence permit shall be rejected.

Good character

The foreigner is obliged to supply a copy of its criminal records information or equivalent issued by the authorities of the last country (or two countries) where the foreigner has resided in the 5 years prior to Monaco.

Other formal requirements

Additionally, the following documents of the foreigner shall be provided to Monegasque Authorities:

- A valid passport or identity card.

- Birth certificate.

- If the foreigner is married or divorced, a marriage/divorce certificate.

- If the foreigner has children under 16, a passport or identity card for each child.

Finally, you shall make an appointment with the Residency, Certifications, and Lost-and-Found Section to have an interview about your residency application.

All documents mentioned above shall be submitted at the same time as filling out the resident application.

If the above requirements are met by foreigners, they would be granted the residence card “Carte de Sejour” by Monegasque Authorities, which allows them to live in Monaco.

This residence permit doesn’t turn a foreigner into a Monegasque national. For this to happen, additional conditions shall be met.

Monaco residency process

If you’re interested in obtaining a residence permit in Monaco, you will have to go through different stages.

Obtaining a visa or long-stay permit

This stage only applies to non-EEA citizens, including UK citizens (not to EU or EEA citizens).

In this regard, non-EEA citizens would have to apply for a long-stay permit through the French Consulate or Embassy closest to their most recent place of residence.

However, if you have already been in France for longer than a year, you would have to apply for a transfer of residency from the French Embassy in Monaco.

Once the long-stay permit (type-D visa) is granted, you can apply for a residence permit.

Application to Monaco residence permit

Both EEA citizens and non-EEA citizens with a long-stay permit can apply for a Monaco residence permit if the requirements mentioned above are met.

If your case is approved after you’ve had the interview with the Residents Section of the Monaco government, your residence permit will be available within a maximum of 6 weeks (we must mention that it could take longer).

Once is granted, one of the following residence permits shall be obtained:

- A Temporary residence permit: This is granted to first-time residents. It is valid for one year and it may be renewed for 3 consecutive years.

- An Ordinary residence permit: This is a permanent residence permit granted to people who have lived in Monaco for 3 years. This permit may be renewed 3 times for another 3 years period.

Finally, keep in mind that if any of the above residence permits are obtained, foreigners shall be residing (in person) in Monaco for at least 3 months per year.

Conditions to become a Monegasque national

If you wish to be a Monegasque citizen, you should take into account the following considerations:

- You have to live in Monaco for at least 10 consecutive years.

- You have to directly apply to the Sovereign Prince of Monaco, whose process may be longer in comparison to other residence permits.

- You have to be exempted from military service obligations in your country of origin.

- You have to renounce your previous nationality (dual nationality is not possible).

Even if foreigners comply with the requirements, the Monaco government can reject the application. Note that it’s not possible to appeal it, even though the foreigner may re-apply as many times as they like.

Advantages of Monaco residency

Once you are granted your residence permit in Monaco, you will be able to enjoy the benefits of living in Monaco. In particular, among others, the most relevant advantages of being a resident in Monaco are the following:

- Monaco is one of the safest countries in Europe, with great life quality and climate. This, together with its location and its favorable tax structure makes it one of the most attractive places to live in Europe.

- Obtaining a residence permit allows you to live indefinitely in Monaco (even though the permit has to be renewed on a regular basis). Once granted, the residence permit covers the whole family, that is, your spouse or common-law partner and children.

- The residence permit offers you the possibility of visa-free travel to more than 160 countries around the world.

- Monaco has a more favorable tax structure in comparison to other EU countries. If you’re interested in knowing more about the tax structure of Monaco, please read our guide on Monaco taxes.

How to take the first step?

At Relocate&Save we have been helping entrepreneurs, high-net-worth individuals, sportspeople, and people from the world of cryptocurrencies to transfer their tax residency to Monaco for years.

In fact, our presence and contacts in Monaco make us an ideal travel partner for this arduous task. So if you are interested in changing your tax residence to Monaco and would like us to help you with the process, please write to us at [email protected].

If you are interested in changing your tax residence to Monaco, we recommend you to download “The definitive guide to living and paying taxes in Monaco”, available for free below.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.