In recent years, from Relocate&Save we’ve helped a hundred individuals and companies to move their tax residence to countries where cryptocurrencies enjoy reduced taxation.

Portugal, Andorra, and Panama are highly sought-after destinations, but those who wish to pay 0% tax on the sale of cryptocurrencies legally and without risk only have one alternative: the United Arab Emirates, and more specifically Dubai.

Why is Dubai the best place to sell cryptocurrencies?

Many investors have made huge capital gains with cryptocurrencies in recent years, which logically involves going through the cashier and paying very high tax rates.

If you’re one of them, and you aspire to bank part of your crypto assets by getting rid of the voracity of Western tax agencies… You should be aware of Dubai, considering that this city in the United Arab Emirates offers great tax advantages to crypto-investors.

Dubai is known to have a 0% personal income tax. This means that if you’re a tax resident in Dubai, no matter how much profit you make, you won’t have to pay a single dollar for it.

What not everyone knows is that this full exemption covers cryptocurrencies as well: whether you actively trade or loiter, you will enjoy 0% tax on gains from cryptocurrency activity.

This is something completely unusual, as most tax authorities treat cryptocurrency gains with a capital gains tax.

In addition, the rest of the world usually requires extensive recording and tracking of their transactions, as well as exhaustive accounting (FIFO, LIFO, etc.)

However, this is not Dubai’s case at all.

How much tax is paid when selling cryptocurrencies?

As we’ve mentioned, in Dubai there’s no Personal Income Tax or law regulating it, and cryptocurrencies are exempt from taxation in its free zones since September 2021.

And this exemption covers any cryptocurrency operations: sale, staking, high-frequency or algorithmic trading, DeFi or farming, mining or sale of NFTs…

However, it should be noted that the cost of living in Dubai is considerable, so depending on the size of your assets, you may not want to relocate.

Generally, users who want to relocate their residence to Dubai are:

- Crypto traders with earnings in excess of €300,000 per year.

- Large holders who want to cash out of cryptocurrencies above €500,000.

- Large holders who want to avoid tedious accounting.

- Large-scale farming and staking professionals.

- Top-level NFT artists.

Do I have to live in Dubai to enjoy these benefits?

Yes, you must be a tax resident in one of Dubai’s Free Trade Zones to benefit from Dubai’s beneficial tax regime.

Important: we at Relocate&Save help our users to obtain tax residency changes. If your real intention is not to live in the new country for the legal minimum of days, we won’t be able to assist you.

And to become a tax resident in Dubai, you must meet these two requirements:

- Obtain an administrative residency through a Business Visa or through an investment in assets of the country (e.g., real estate).

- Stay more than half of the year to be able to apply for a tax certificate from the Emirati authorities or the corresponding consulates.

Until recently, the Emirati Ministry of Finance didn’t issue tax residency certificates. This meant that anyone who moves there couldn’t prove their tax residency, as the only certificate issued was a certificate of nationality.

Fortunately, the Ministry of Finance now issues tax residency certificates to individuals who can prove that they’ve resided in Dubai for more than 183 days during a tax year.

However, please note that many of these certificates aren’t for the purposes of the agreements signed between the Emirates and the countries of origin.

This is because they state that they will only apply to Emirati nationals (but not to non-resident non-nationals).

What are the other crypto advantages of residing in Dubai?

One of the main problems encountered by those trading cryptocurrencies is calculating the profits derived from their sale.

Those who only loiter don’t have this complication because they hardly make operations per year, but those who opt for trading or other activities with frequent transactions face real headaches.

This is because states often require accounting for profits via “First in First out” (“FIFO”) analysis (pejorative for early adopters), “Last in First out” (“LIFO”), or in accordance with IFRS-IRS accounting legislation.

Not to mention that those who do it through an investment fund will be governed by the strict MIFID II (even for a closed-end fund).

All these issues disappear in Dubai: if you trade cryptocurrencies on a personal level, in the UAE you won’t be required to do any accounting or reporting, so you can forget about costly and difficult calculations.

However, if you bank or want to cash out, you will have to prove the traceability of the coins and their legal origin.

For this purpose, we recommend consulting experts and avoiding DeFi circuits or mixers that further muddy the traceability.

If you would like advice on this aspect, please contact us.

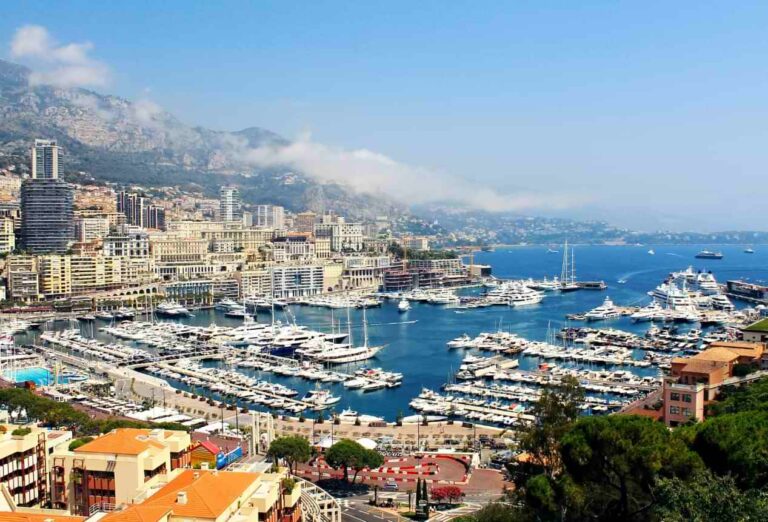

Dubai, a crypto-friendly city

If you’re involved in the sector, you’ll know that many cryptocurrency conferences take place in Dubai and Abu Dhabi.

Not for nothing has the Emirati government boosted the presence of crypto assets in the Persian Gulf country in recent years.

In fact, Sheikh Mohammed bin Rashid Al Maktoum recently approved the virtual assets law and created the Dubai Virtual Assets Regulatory Authority (VARA).

Since then, reputable banks with SEBA and Sygnum, and exchanges of the caliber of Binance have already set up shop in Dubai. So anyone moving to the emirate can be sure to find themselves in one of the most crypto-friendly environments in the world.

Can I buy in Dubai with cryptocurrencies?

Yes, another great advantage is that in some free trade zones in Dubai and Abu Dhabi, it’s allowed to buy luxury cars and even real estate with cryptocurrencies, without the need to convert them to fiat.

Although this isn’t very common yet, you could get to use your own cryptocurrencies to buy a home for your Dubai stay.

How to take the first step?

Relocate&Save specializes in tax residence transfers to Dubai for entrepreneurs, high-net-worth individuals, sportsmen, and cryptocurrency professionals.

Our presence and contacts in Dubai make us an ideal travel partner for this arduous task. If you have any questions or would like us to help you with the process, please write to us at [email protected] or via the contact form.

And if you’re considering a change of tax residence, but are still not sure about your ideal destination, we recommend you to read the free report “The top three tax destinations right now”, available below.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.