The global tax system is changing and the trend is towards global tax harmonization. However, the tax policy of low taxes and exemptions is still a frequent strategy among countries that aspire to attract capital to boost their economic development.

Among them is the Republic of Cyprus, which has established itself as one of the most attractive destinations for investors and individuals seeking not only a safe, stable destination with a high standard of living, but also a fiscally attractive environment.

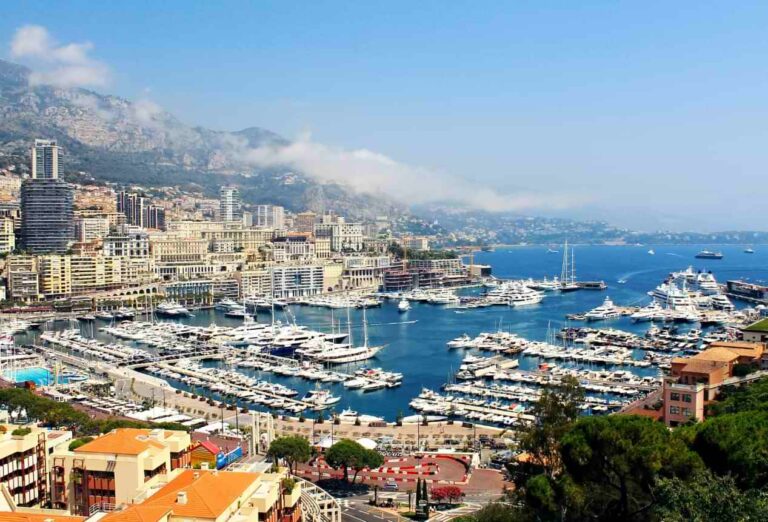

Cyprus is a country covering two thirds of the island of the same name located in the eastern Mediterranean Sea, at the crossroads between Europe, Africa and Asia, in an area of confluence of the busy sea routes of these three continents.

In recent years, Relocate&Save has helped numerous companies and individuals relocate to Cyprus, and in this guide we will give an overview of Cypriot taxation and obtaining Cypriot residency.

What taxes are paid in Cyprus?

The attractiveness of Cyprus as a place to live and an investment destination is enhanced by its advantageous tax regime, which offers incentives to both individuals and companies.

Cyprus is one of the countries in the European Union with the lowest tax burden and, as a member of the Eurozone, it guarantees legal certainty, stability for investment and access to a market of about 500 million EU citizens.

There are two main taxes faced by individuals and legal entities in Cyprus:

- Personal income tax

- Corporate income tax

The Personal Income Tax in Cyprus is progressive, i.e. the more you earn, the more you pay.

Starting from a minimum income of €19,500 per year, paying a rate of 20%, up to those earning more than €60,000 per year who must pay 35%. Dividends and interest income are exempt.

As you can see, Cyprus personal income tax is not particularly attractive. Therefore, foreigners moving to this country apply for the non-domiciled regime whereby the individual is generally taxed on income generated in Cyprus.

We will explain this regime in more detail below.

Corporate income tax, on the other hand, is 12.5%, one of the lowest tax rates in Europe.

Also, in general terms, dividends, interest and royalties are exempt from taxation thanks to the application of the so-called “participation exemption” or exemptions on financing.

Other taxes in Cyprus are:

- Real estate tax, for which between 2.5% and 4% is paid depending on the value of the property.

- Capital gains tax (e.g., on sale of real estate) of 20%.

How to become a Cyprus tax resident

Cyprus offers a large number of tax exemptions to foreigners who decide to settle in this country. In order to be considered a tax resident in Cyprus, the interested party must relocate his or her tax residence to Cyprus and also apply for non-dom status.

There are three ways to do this:

- The classic “non dom”, which only requires staying in the country for at least two months per year to apply as a resident.

- A “non dom” for entrepreneurs, which requires the incorporation of a company in the country and the payment of 14.8% to social security.

- “non dom”, for high net worth individuals, which requires proving that they have a monthly income of more than €6,000. This income can originate from dividends from foreign source companies.

As we said, the key to residency in Cyprus is this “non-dom” regime, since there is absolutely no income tax to be paid on income from abroad. In the case of teleworkers, content creators, traders, marketers, etc., they can substantially reduce their taxation by moving to Cyprus.

Permanent residence program for investment

With the intention of attracting investment capital to the country, Cyprus also implemented in 2016 the Cyprus Permanent Residency program, which grants permanent residency to non-EU citizens who invest in the Republic of Cyprus.

This investment promotion strategy, which facilitates foreign citizens to obtain Cypriot permanent residency on an exceptional basis in exchange for a capital investment, has meant a significant boost to the Cypriot economy. The program has undergone several modifications, the last one in March 2021.

To qualify for permanent residency through the investment-based residency program, the applicant must make a minimum investment of €300,000 (excluding VAT) and must use income from outside Cyprus. The investment options are as follows:

- New residential properties and commercial properties such as offices and hotels (new or resale).

- Equity investment in a Cypriot company that has a physical presence in this country and employs at least five people.

- Purchase of a participation in a local investment fund, but the requirement is that it be a collective investment fund (OICVM).

Regardless of which option is chosen, the applicant must attach a residence address in Cyprus, either an owned or rented dwelling.

The applicant’s immediate family members qualify as dependents of the application, including spouse, children up to the age of 25 and parents of the investor.

The investor’s minimum annual income must be at least €30,000, plus €5,000 for each dependent applicant family member of the investor and €8,000 for each dependent parent or parent-in-law.

The investor and spouse will not be eligible for employment in Cyprus and the investment money must come from outside sources. However, they may serve as directors of a Cypriot company.

Why relocate to Cyprus?

As mentioned above, obtaining resident status in Cyprus offers a range of tax incentives and opportunities of all kinds, especially for non-EU residents.

In the case of permanent residence by investment, for example, this status opens the doors to those who wish to do business in Europe as non-EU citizens.

For this reason, Cyprus has been a destination par excellence for Russian citizens, from the “CIS countries” and from Southeast Asia.

Since Cyprus is an EU country and is part of the Schengen Area, investors and their family members holding permanent residence permits can move freely in Europe without the need to apply for a cumbersome visa.

In short, Cyprus remains an attractive destination not only for tourism, but also to develop your business or to receive your income with a low tax burden.

How to take the first step?

At Relocate&Save we have local lawyers specialized in obtaining residency in Cyprus. If you are interested in changing your tax residence to this country, please write to us using the contact form or to [email protected].

And if you are considering moving to another country, but are not sure which is your ideal destination, download our report “The top three tax destinations right now”, available for free below.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.